https://www.youtube.com/watch?v=w-Aw8CB3a5M&index=3&list=PLlbslWWQNsnVQNuMerA1M1Pq9EcQX-PwT

Click to Play Talkin’ Money Video

Getting your first paycheck is an exciting thing. Then you look at the actual amount of the check and you think there must have been a mistake! It’s because they take out taxes and employee benefits from you pay. You should take the time to understand what they deduct from your paycheck, and why.

High school students usually first become aware that the money you make per hour, multiplied times the hours they worked each week, did not add up to the amount they actually received in their check for the pay period. Gross pay is the amount you are paid, before taxes are taken out, Net pay is the actual amount of the check, with all of the taxes and benefits deducted.

Here are the different items they deduct from an average paycheck:

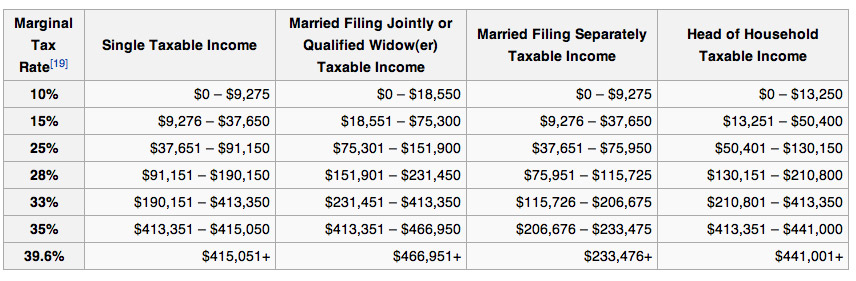

Federal Tax – also known as income tax. it can range from 15 to 39.6% of the total. The more you make, the more you pay. Here’s a basic table of income tax rates for 2016:

State Tax – this is the State Income tax paid depending on which state you live in. Currently seven states have no state income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming.

FICA – This is the social security tax. You pay 6.2% of your income to FICA. In addition, your employer pays and additional 6.2% for you. It provides you with a guaranteed retirement benefit when you are in your 60’s.

MEDI – This is for Medicare. You pay 1.45% of your income to Medicare. Your employer also pays an additional 1.45% for you. It provides you with health care benefits when you are in your 60’s.

OTHER – Other items that can be deducted from your paycheck are for Life Insurance, Health Insurance, Retirement Plans, Flexible Spending Account Deduction (which is a health savings plan) and Employee Stock Plans. There may be other items deducted as well which are usually part of an employee benefits plan.

BTW, besides Financial Literacy Month, April is also Tax Month, with your personal tax returns due on April 15th. Did you file your return yet?