Sometimes stepping back and looking at where you stand can have a great impact on your approach to things. The same can be said for a Career Plan. At various stages of your life, having a Career Plan, and reviewing that plan can keep you on the right path, helping you achieve a higher salary, job security and a rewarding career – doing what you love.

Sometimes stepping back and looking at where you stand can have a great impact on your approach to things. The same can be said for a Career Plan. At various stages of your life, having a Career Plan, and reviewing that plan can keep you on the right path, helping you achieve a higher salary, job security and a rewarding career – doing what you love.

Ask yourself these questions:

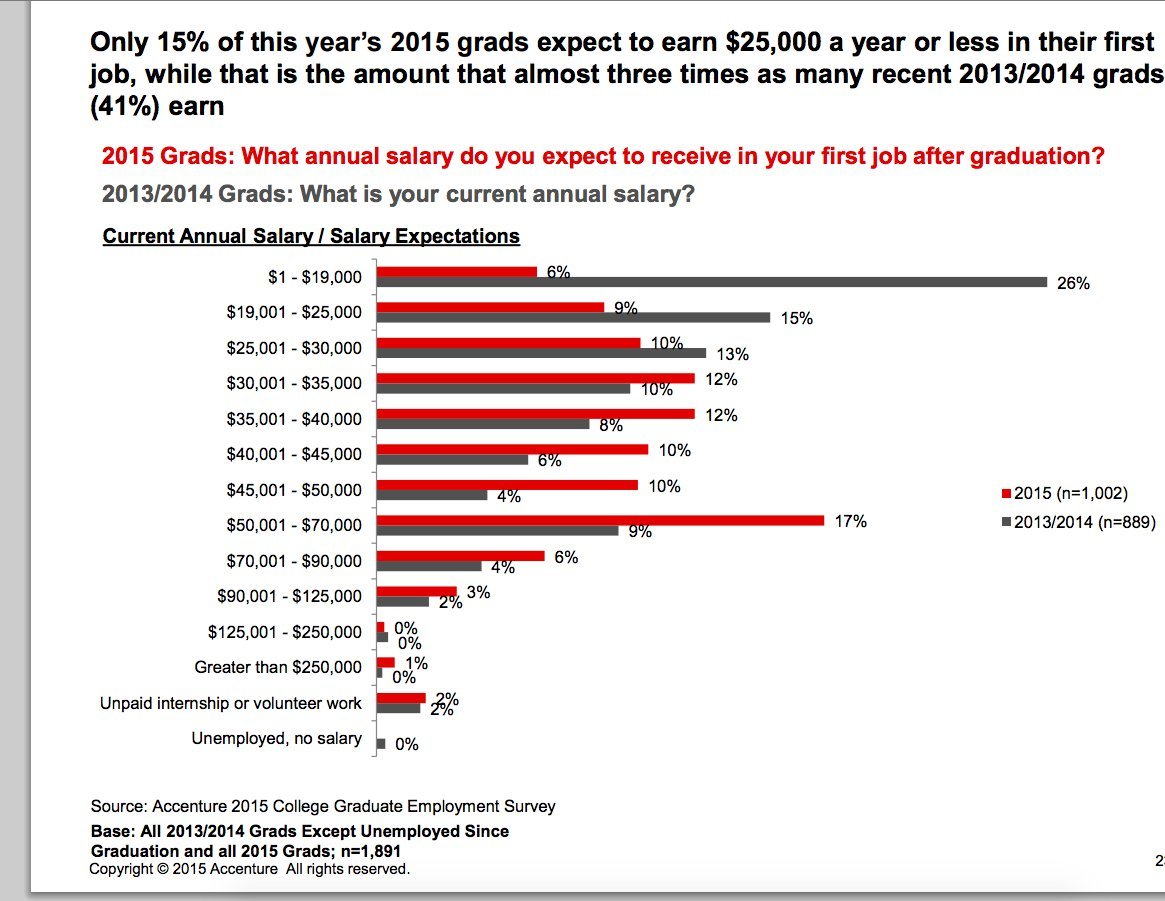

What is the marketability of the degree you are pursuing?

Are there steps you might take to add to your potential employ-ability and earning power?

A career plan is simply a step-by-step assessment, finding out the things you need to do, and the order you need to do them in, to get the career you want. For college-aged folks, taking the time to establish a career plan can act as a blueprint for building your career.

1 – Assess yourself, Take time now to learn how your skills, values, interests, and personality might influence your career choices.

2 – Understand the careers available to your career choice. Do you really know what jobs you might qualify for upon graduation?

3 – Participate in your career choice. Set yourself apart from other recent graduates, participate in internships, mentoring programs, and other work-based learning experiences.

4 – Network. Look for career-related student group, professional associations, or other groups that can help you to network.

Taking the time to organize yourself with a Career Plan helps you take the right steps to your career future.

April is National Financial Literacy Month, Talkin’ Money’s favorite month! To celebrate the importance of being financially literate, we’re going to post financial literacy tips every day.

Sometimes stepping back and looking at where you stand can have a great impact on your approach to things. The same can be said for a Career Plan. At various stages of your life, having a Career Plan, and reviewing that plan can keep you on the right path, helping you achieve a higher salary, job security and a rewarding career – doing what you love.

Sometimes stepping back and looking at where you stand can have a great impact on your approach to things. The same can be said for a Career Plan. At various stages of your life, having a Career Plan, and reviewing that plan can keep you on the right path, helping you achieve a higher salary, job security and a rewarding career – doing what you love.

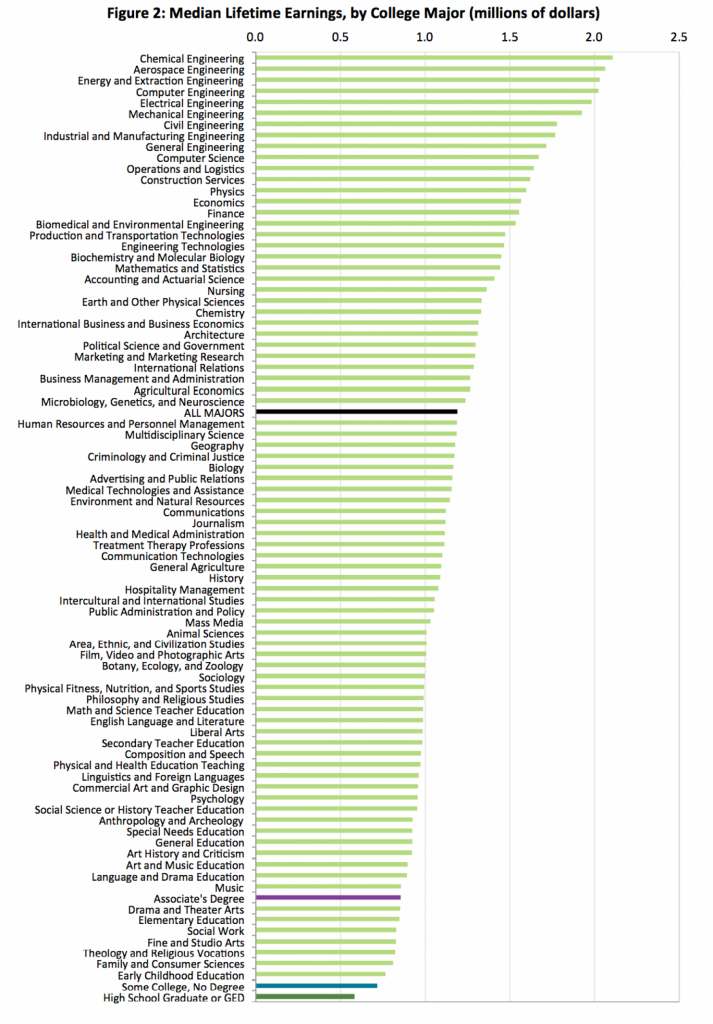

We’ve been telling you that you are all millionaires since we began this series.

We’ve been telling you that you are all millionaires since we began this series.