How many times have you passed by an electronics store and saw the X-Box you always wanted was finally on sale or the newest smart phone has hit the market? Temptations are thrown at us everyday in many different forms of ads. They know how to get your attention.

How many times have you passed by an electronics store and saw the X-Box you always wanted was finally on sale or the newest smart phone has hit the market? Temptations are thrown at us everyday in many different forms of ads. They know how to get your attention.

But where do you stand financially? Are you strong enough to stick to your budget or are you ready to throw caution to the wind? If so, then let’s at least recognize that there are alternatives & consequences to most financial decisions.

Think of setting financial goals so you can purchase these items by saving for it on a monthly basis. But remember, the more you save, the more you have to sacrifice other things like movies or eating out. So there’s your alternative, but if you spend and don’t have it, the consequences means going into more debt.

We’ve all heard and read a thousand times how we should save on a regular basis and the younger you start the more we’ll have when getting closer to retirement. But as sure as the sun rises there will always be something that happens in your life that will make it difficult for you to part with your money to put into savings. That’s why every paycheck you should have a set portion of your salary automatically deposited into your savings account.

We’ve all heard and read a thousand times how we should save on a regular basis and the younger you start the more we’ll have when getting closer to retirement. But as sure as the sun rises there will always be something that happens in your life that will make it difficult for you to part with your money to put into savings. That’s why every paycheck you should have a set portion of your salary automatically deposited into your savings account. April 15th, ‘tax day’, always seems to be a day of chaos and dread for taxpayers – though thru some convoluted rules, ‘tax day’ is actually April 18th this year. We’ve all seen traffic jams and long lines at local Post Offices with last minute taxes held tightly in their hands hoping to get their taxes sent out on time.

April 15th, ‘tax day’, always seems to be a day of chaos and dread for taxpayers – though thru some convoluted rules, ‘tax day’ is actually April 18th this year. We’ve all seen traffic jams and long lines at local Post Offices with last minute taxes held tightly in their hands hoping to get their taxes sent out on time. When preparing for tax time don’t just assume that Federal, State and other income taxes will be the only thing you can declare hoping you’ll get some kind of tax return. Depending on what kind of job or jobs, or what kind of savings or purchases you’ve made, you may qualify to reduce your taxable income and get a larger refund.

When preparing for tax time don’t just assume that Federal, State and other income taxes will be the only thing you can declare hoping you’ll get some kind of tax return. Depending on what kind of job or jobs, or what kind of savings or purchases you’ve made, you may qualify to reduce your taxable income and get a larger refund. When you’re young and just starting out in the workforce and lucky enough to be able to join in an employee sponsored savings plan but you’re not sure if you should. Here’s the answer: Yes, definitely, do not hesitate. I hope that’s clear enough. To understand it better let’s take a look at the definition.

When you’re young and just starting out in the workforce and lucky enough to be able to join in an employee sponsored savings plan but you’re not sure if you should. Here’s the answer: Yes, definitely, do not hesitate. I hope that’s clear enough. To understand it better let’s take a look at the definition. There’s one private investigator who’s middle name is ‘Identity Theft’! Talkin’ Money’s own Frank Money!

There’s one private investigator who’s middle name is ‘Identity Theft’! Talkin’ Money’s own Frank Money! When you think about it Insurance and Risk Management are really the same thing. Adults who own homes have all kinds of insurances including protecting their home and belongings. But when first starting out in the working world, or even before when attending college, insurance is also a must have.

When you think about it Insurance and Risk Management are really the same thing. Adults who own homes have all kinds of insurances including protecting their home and belongings. But when first starting out in the working world, or even before when attending college, insurance is also a must have. Here’s a question for you. What’s the most expensive purchase you’ll make in your life? A car? Nope. A house? You might think so but you would be wrong. Actually, it’s your retirement. Bet you didn’t think about that answer.

Here’s a question for you. What’s the most expensive purchase you’ll make in your life? A car? Nope. A house? You might think so but you would be wrong. Actually, it’s your retirement. Bet you didn’t think about that answer. As if millennials don’t have enough challenges today to secure their finances, there will always be pressure coming from all sides including your friends, co-workers and even the media that will affect the way you spend your money.

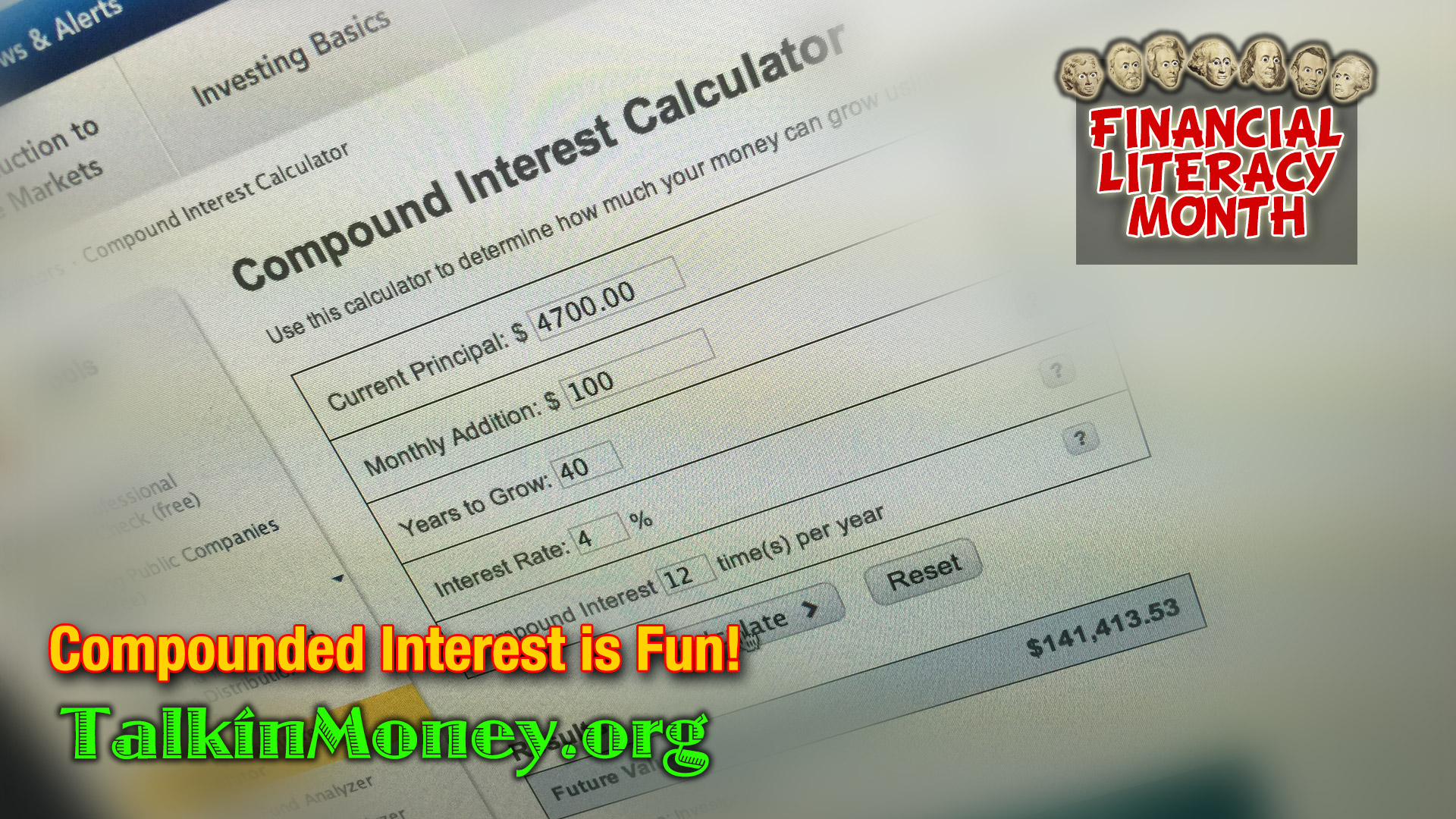

As if millennials don’t have enough challenges today to secure their finances, there will always be pressure coming from all sides including your friends, co-workers and even the media that will affect the way you spend your money. The prettiest two words you ever want to hear when investing are: Compounded Interest. A perfect example comes from the one and only Benjamin Franklin.

The prettiest two words you ever want to hear when investing are: Compounded Interest. A perfect example comes from the one and only Benjamin Franklin.