We’ve all heard and read a thousand times how we should save on a regular basis and the younger you start the more we’ll have when getting closer to retirement. But as sure as the sun rises there will always be something that happens in your life that will make it difficult for you to part with your money to put into savings. That’s why every paycheck you should have a set portion of your salary automatically deposited into your savings account.

We’ve all heard and read a thousand times how we should save on a regular basis and the younger you start the more we’ll have when getting closer to retirement. But as sure as the sun rises there will always be something that happens in your life that will make it difficult for you to part with your money to put into savings. That’s why every paycheck you should have a set portion of your salary automatically deposited into your savings account.

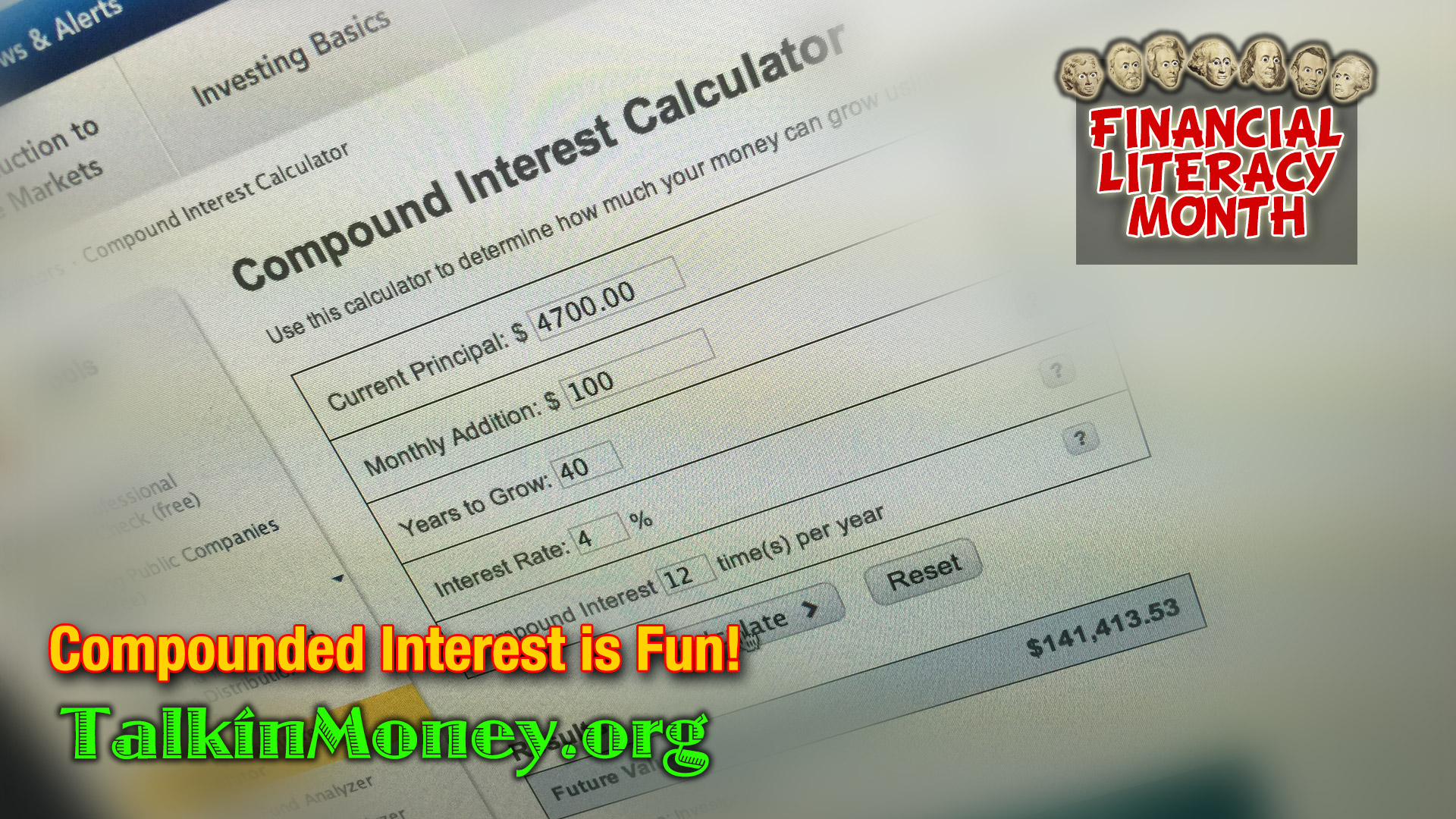

The later you wait to start saving, even a year or two, could mean the difference of up to $200,000 or more! Remember compounding interest? Over time your money will make more money for you.

In fact, if you want to have what we financial literacy fans call ‘fun’ here’s a link to the government’s Securities and Exchange Commission’s handy, dandy Compounded Interest Calculator. GO ahead, plug some numbers in and step back, ready to be surprised!

https://www.investor.gov/tools/calculators/compound-interest-calculator

Good old Benjamin Franklin once said: “An investment in knowledge pays the best interest.” So it’s up to you to be a wise investor with your savings.

When you’re young and just starting out in the workforce and lucky enough to be able to join in an employee sponsored savings plan but you’re not sure if you should. Here’s the answer: Yes, definitely, do not hesitate. I hope that’s clear enough. To understand it better let’s take a look at the definition.

When you’re young and just starting out in the workforce and lucky enough to be able to join in an employee sponsored savings plan but you’re not sure if you should. Here’s the answer: Yes, definitely, do not hesitate. I hope that’s clear enough. To understand it better let’s take a look at the definition.