OK – Listen up! We need to know the R-O-I of that higher education your pursuing?

ROI you ask? That’s RETURN ON INVESTMENT.

Whether it be college, trade or vocational schools you INVEST your time as well as money to get an education. The end result is a career you hopefully will love with yearly earnings being the RETURN.

It’s important to ask yourself – what is the payoff for all your blood, sweat and tears…and cost. It’s time to do the math.

QUESTION 1 – What is the cost of your higher education.

QUESTION 2 – What is the average starting salary of a job in your area of study?

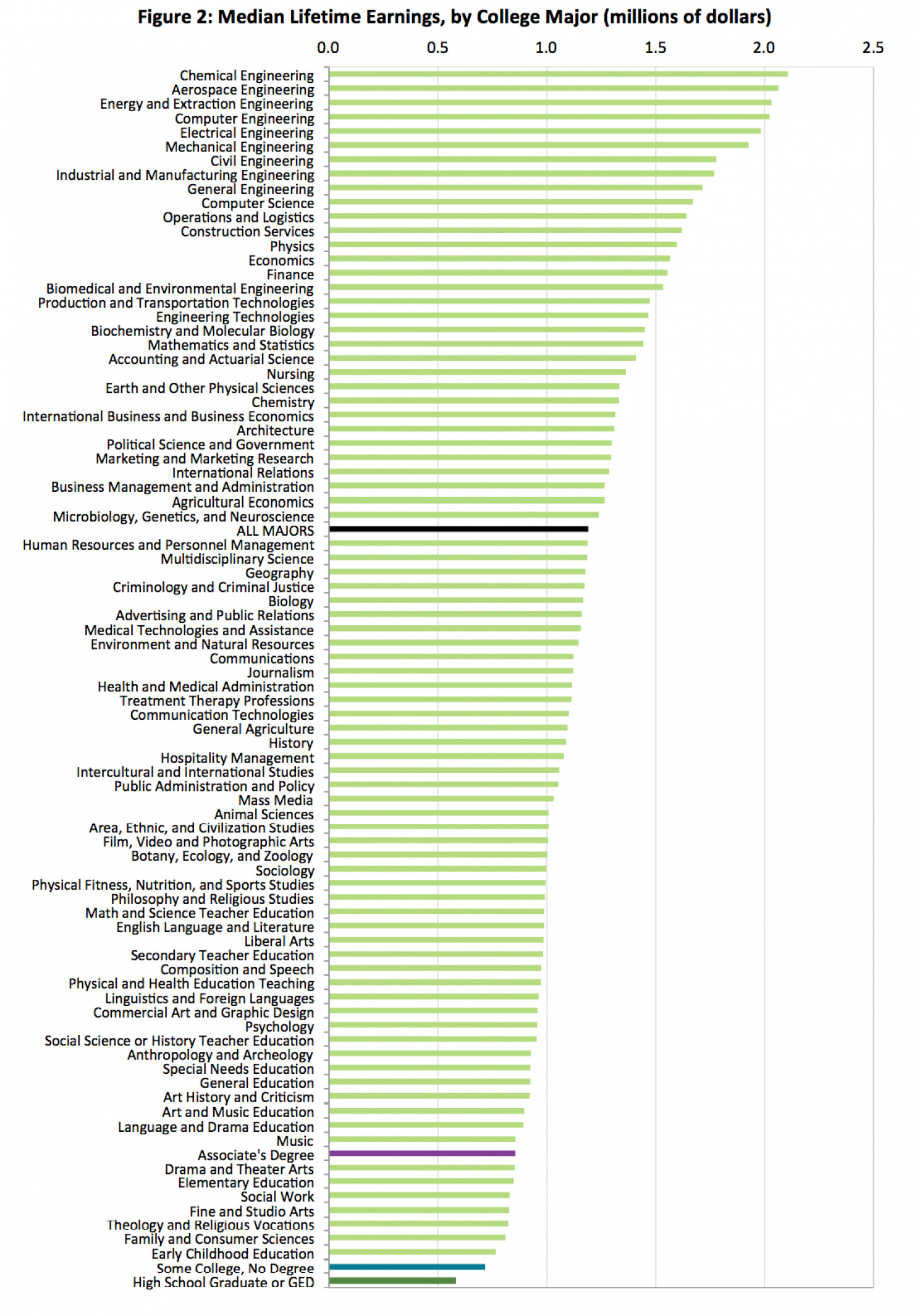

The blog fivethirtyeight.com has a great chart of understanding what the average median earning is for your degree and future job.

http://fivethirtyeight.com/features/the-economic-guide-to-picking-a-college-major/

QUESTION 3 – Now look the first two questions – how many years will you have to work to equal the cost of higher education. In other words, how many years of working will it take you to break even in paying back that cost of education.

That’s your ROI.

Life is about pursuing interests that you love, but it’s equally important to consider the path you take and whether the return will be worth it.

April is National Financial Literacy Month, Talkin’ Money’s favorite month! To celebrate the importance of being financially literate, we’re going to post financial literacy tips every day.