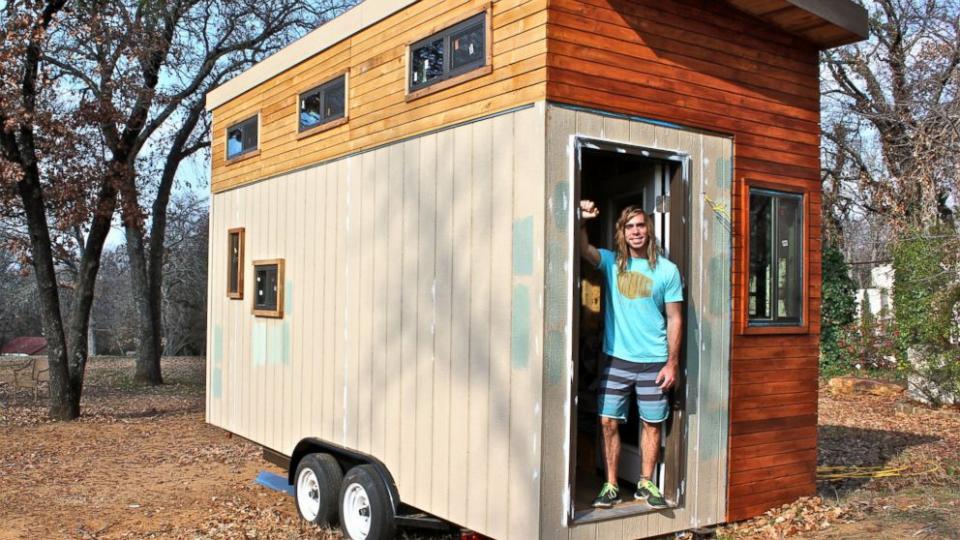

Sometimes just being clever is the best way to save yourself money! From Good Morning America – Texas Man Builds Miniature House in Hopes of Avoiding College Debt!

Joel Weber said he’s determined to incur less college debt by living in the tiny, 145-square-foot house he built, rather than struggling to pay higher rent in his college town of Austin, Texas.

“I wanted a place to call home,” Weber told ABC News. “I wanted it to be affordable so I could be debt-free and let it be an investment to give back to the community — not just dumped into rent that I wouldn’t get any return on.”

Weber, who will begin his junior year at the University of Texas at Austin, said it can cost upwards of $800 a month to live in the area near his school.

Click here for more of the article