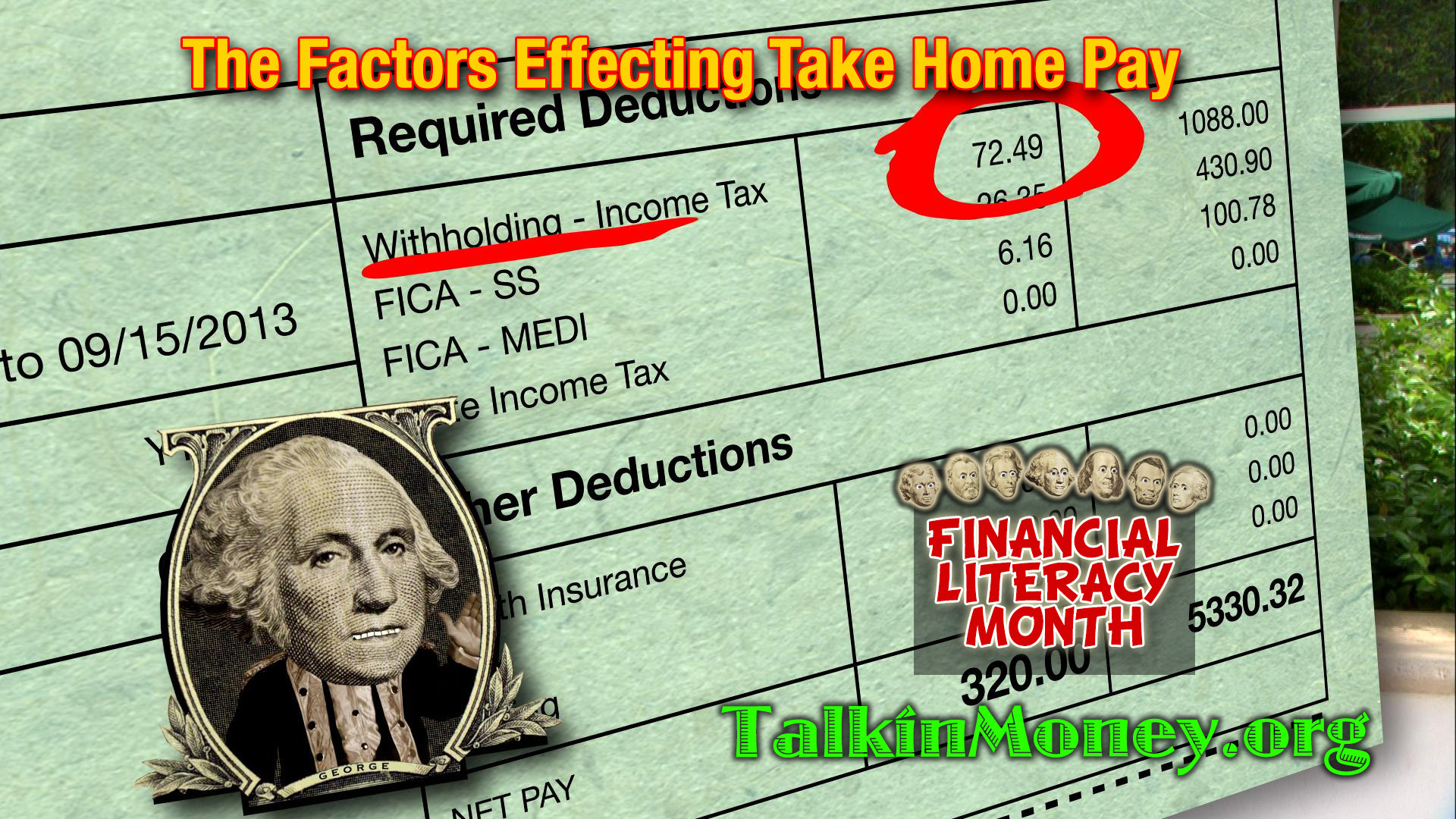

It’s just a hunch but I’m willing to bet that a lot of you earning a paycheck don’t fully understand all the deductions that are taken from your gross amount. First of all, these deductions are actually called taxes. That’s right, you’re now in that exclusive club that helps run our country as smooth as it can.

It’s just a hunch but I’m willing to bet that a lot of you earning a paycheck don’t fully understand all the deductions that are taken from your gross amount. First of all, these deductions are actually called taxes. That’s right, you’re now in that exclusive club that helps run our country as smooth as it can.

Depending on what state you live in determines how much in taxes you pay. The basic taxes we all pay are Federal Income Tax, Social Security and Medicare. Federal is just how it sounds. It pays for what’s needed throughout our country including National Defense. Social Security is there to assist you financial when you reach retirement age. Trust me, you’re going to need that. As you will with Medicare, that’s also for retirement age to assist with basic health care.

All states are not created equal when it comes to taxes. A number of states have a State Tax and could also have a City Tax. There lots of other taxes out there but I think you get the idea. Death and taxes…I’ll take taxes!

It’s Tax Day! Normally, Tax Day is April 15th, but this year it’s April 18th! Why the change to April 18th? Well, in typical Washington-DC fashion…it’s complicated…here’s the reason why –

It’s Tax Day! Normally, Tax Day is April 15th, but this year it’s April 18th! Why the change to April 18th? Well, in typical Washington-DC fashion…it’s complicated…here’s the reason why –  How many times have you passed by an electronics store and saw the X-Box you always wanted was finally on sale or the newest smart phone has hit the market? Temptations are thrown at us everyday in many different forms of ads. They know how to get your attention.

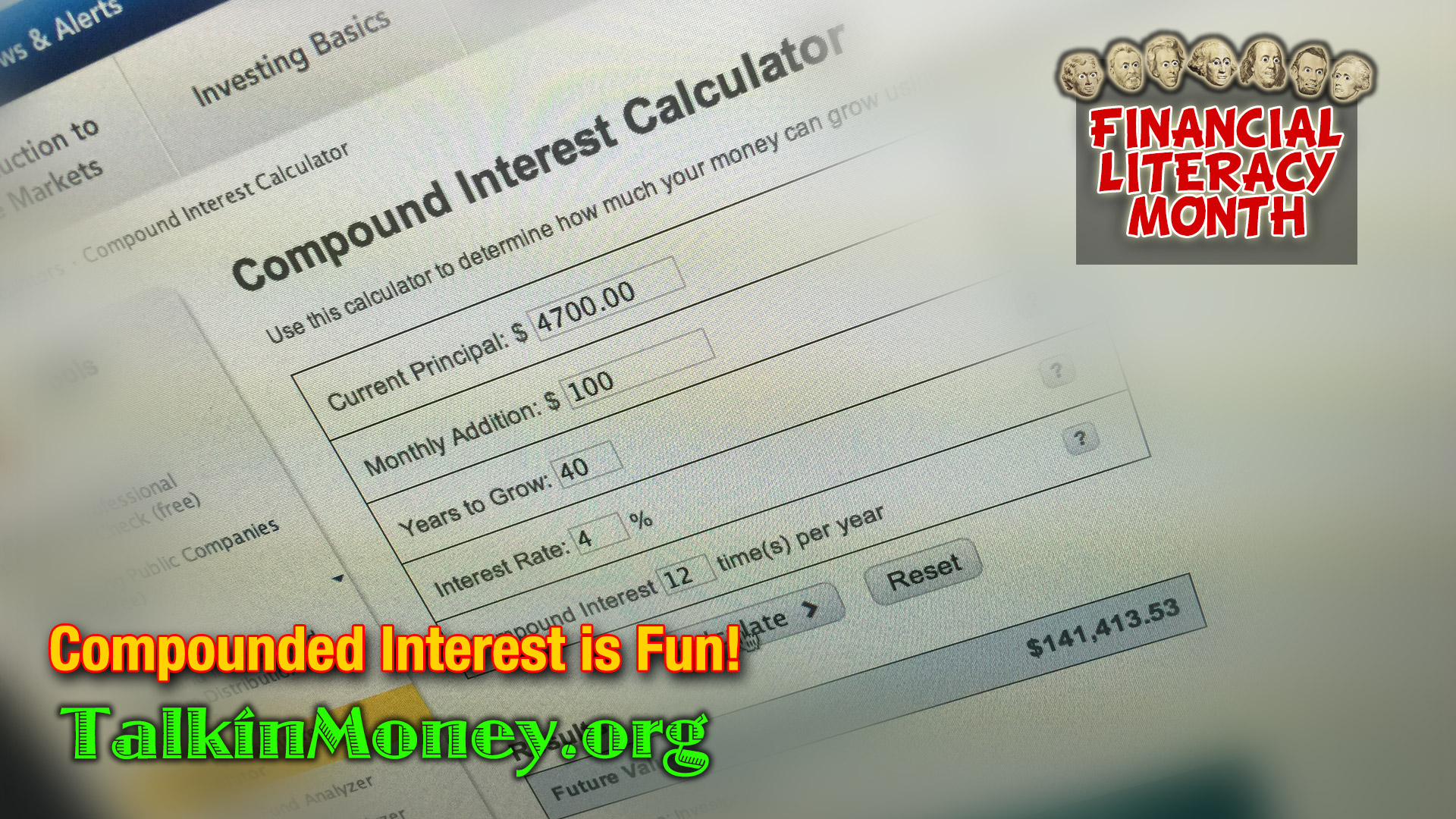

How many times have you passed by an electronics store and saw the X-Box you always wanted was finally on sale or the newest smart phone has hit the market? Temptations are thrown at us everyday in many different forms of ads. They know how to get your attention. We’ve all heard and read a thousand times how we should save on a regular basis and the younger you start the more we’ll have when getting closer to retirement. But as sure as the sun rises there will always be something that happens in your life that will make it difficult for you to part with your money to put into savings. That’s why every paycheck you should have a set portion of your salary automatically deposited into your savings account.

We’ve all heard and read a thousand times how we should save on a regular basis and the younger you start the more we’ll have when getting closer to retirement. But as sure as the sun rises there will always be something that happens in your life that will make it difficult for you to part with your money to put into savings. That’s why every paycheck you should have a set portion of your salary automatically deposited into your savings account.