Dollar cost averaging is an investment technique where you regularly buy a fixed dollar amount of a particular investment, on a regular schedule, regardless of its price.

Dollar cost averaging can be employed in purchasing just about any investment, though it is commonly used in purchasing stocks and mutual funds. It is also called Constant Dollar Plan.

We all know that the stock market goes up, and the stock market goes down. when to ‘jump in’ can be a difficult guess. A lot of people loose sleep over crazy market gyrations. This is why dollar cost averaging makes sense.

Let’s say you make regular monthly payments into your retirement plan. Or, make monthly payments to yourself, in the form of savings. If you are investing in mutual funds for example, purchasing that fund at a monthly interval, is cost averaging. Regardless of what the stock market is doing, you will buy more shares if the market is low and less shares if the market is high. Over time, you are buying an average, and this helps smooth out the fluctuations of the market.

For example, if you make a $100 per month investment in a mutual fund. In January, the share price was $25, so you were able to buy 4 shares. In February, the share price was $33, so you were able to buy 3 shares. Then in March, the share price was $20, allowing you to buy 5 shares. Over the three months, you purchased a total of 12 shares for an average price of $25 each.

There is an old adage, that you can never time the stock market – in other words, the hope that you buy when market is low and sell when the market is high. Dollar cost averaging is a great strategy that helps your investment grow without having to worry about market timing.

Want to read more? http://www.dummies.com/how-to/content/how-to-use-the-dollarcost-averaging-formula-on-the.html

April is National Financial Literacy Month, Talkin’ Money’s favorite month! To celebrate the importance of being financially literate, we’re going to post financial literacy tips every day.

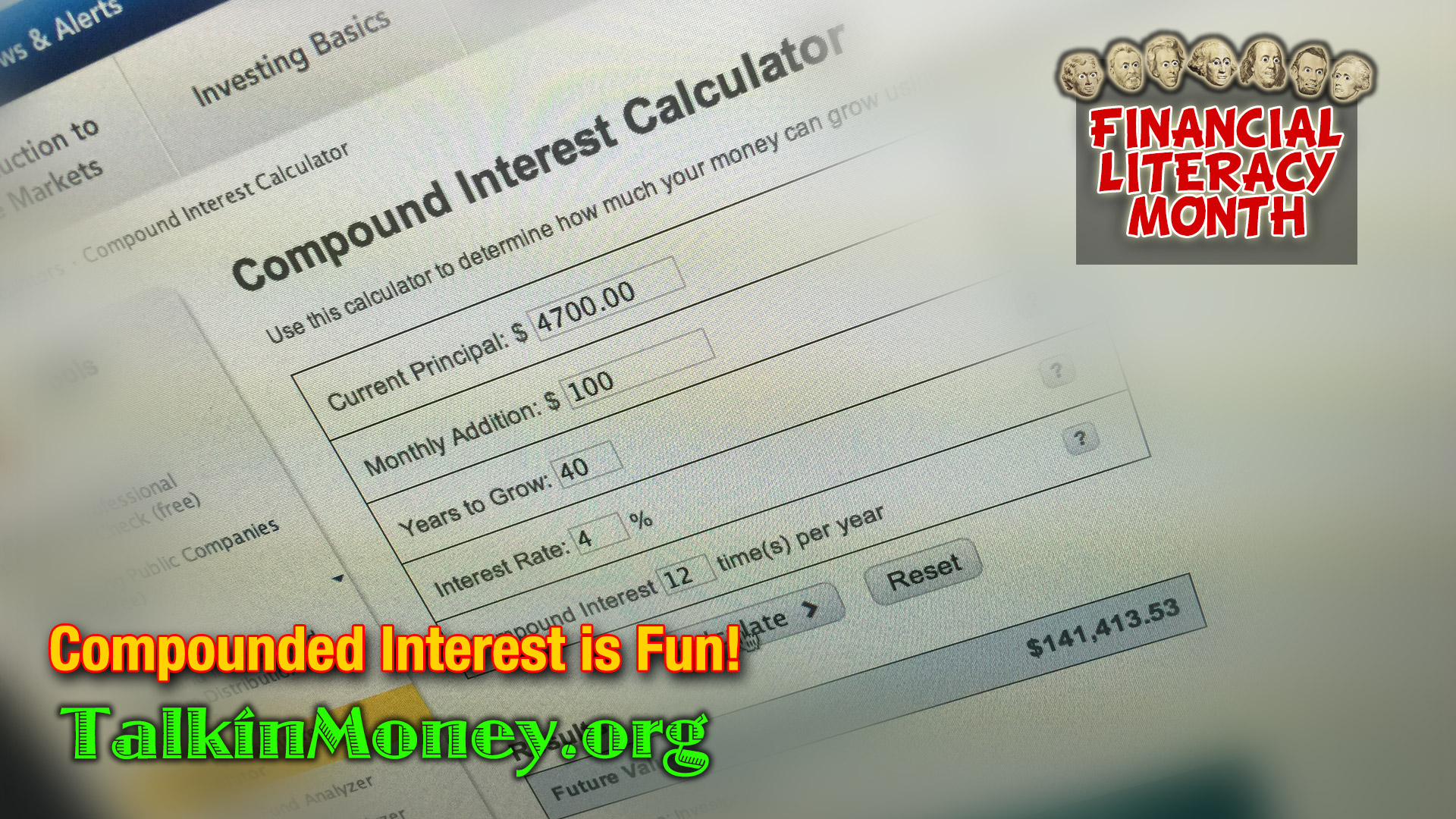

We’ve all heard and read a thousand times how we should save on a regular basis and the younger you start the more we’ll have when getting closer to retirement. But as sure as the sun rises there will always be something that happens in your life that will make it difficult for you to part with your money to put into savings. That’s why every paycheck you should have a set portion of your salary automatically deposited into your savings account.

We’ve all heard and read a thousand times how we should save on a regular basis and the younger you start the more we’ll have when getting closer to retirement. But as sure as the sun rises there will always be something that happens in your life that will make it difficult for you to part with your money to put into savings. That’s why every paycheck you should have a set portion of your salary automatically deposited into your savings account.