It’s Tax Day! Normally, Tax Day is April 15th, but this year it’s April 18th! Why the change to April 18th? Well, in typical Washington-DC fashion…it’s complicated…here’s the reason why – http://www.usatoday.com/story/money/personalfinance/2016/04/09/tax-day-april-18-year-not-april-15/82095452/#

It’s Tax Day! Normally, Tax Day is April 15th, but this year it’s April 18th! Why the change to April 18th? Well, in typical Washington-DC fashion…it’s complicated…here’s the reason why – http://www.usatoday.com/story/money/personalfinance/2016/04/09/tax-day-april-18-year-not-april-15/82095452/#

If you have filed your taxes and signed on the dotted line, then good for you! If this is your first time it’s not that far-fetched that you have joined society; contributed to keeping the wheels oiled and turning so our country can keep moving forward. Okay, sometimes I can get carried away.

With your return due today, we thought we would share another date with you – Tax Freedom Day – This is the day of the year where everything made up to that date goes to Uncle Sam, and after that date, everything you make is yours. In the United States, it is annually calculated by the Tax Foundation, a Washington, D.C.-based tax research organization. In the U.S., Tax Freedom Day for 2015 is April 24, for a total average effective tax rate of 31 percent of the nation’s income. The latest that Tax Freedom Day has occurred was May 1 in 2000. In 1900, Tax Freedom Day arrived January 22, for an effective average total tax rate of 5.9 percent of the nation’s income.

Tax Freedom Day for 2016 is April 27th! Woo Hoo!

April is National Financial Literacy Month, Talkin’ Money’s favorite month! To celebrate the importance of being financially literate, we’re going to post financial literacy tips every day.

As for the second half of the month of April, each day we’re be covering more financial literacy information such as, just what are the taxes taken out of you paycheck, your credit and the benefits of keeping it at a high number, keeping on track using a budget and a lot more.

No peeking! April 19th is tomorrow, and you have just 361 days till your income tax return is due again!

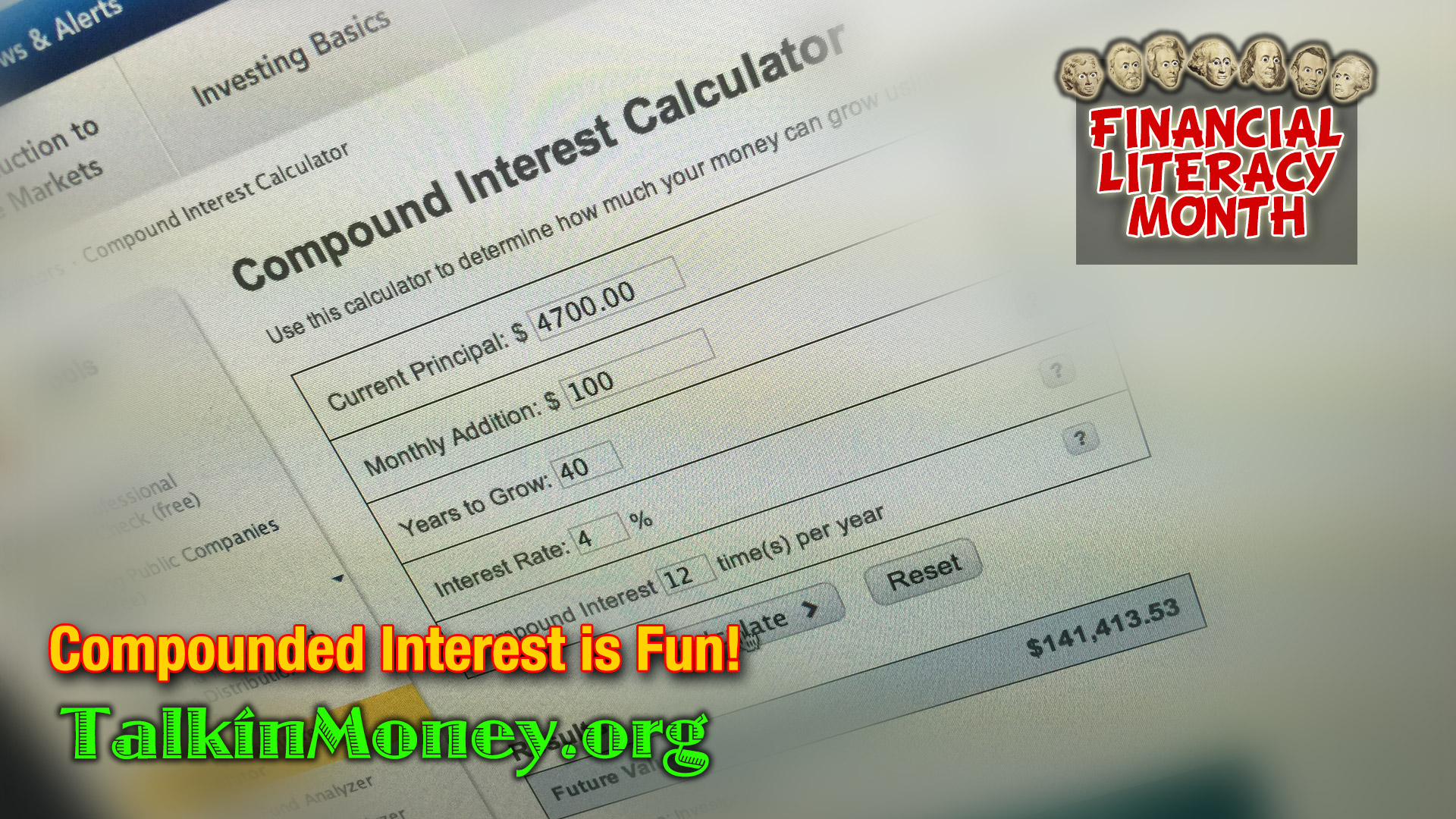

We’ve all heard and read a thousand times how we should save on a regular basis and the younger you start the more we’ll have when getting closer to retirement. But as sure as the sun rises there will always be something that happens in your life that will make it difficult for you to part with your money to put into savings. That’s why every paycheck you should have a set portion of your salary automatically deposited into your savings account.

We’ve all heard and read a thousand times how we should save on a regular basis and the younger you start the more we’ll have when getting closer to retirement. But as sure as the sun rises there will always be something that happens in your life that will make it difficult for you to part with your money to put into savings. That’s why every paycheck you should have a set portion of your salary automatically deposited into your savings account. April 15th, ‘tax day’, always seems to be a day of chaos and dread for taxpayers – though thru some convoluted rules, ‘tax day’ is actually April 18th this year. We’ve all seen traffic jams and long lines at local Post Offices with last minute taxes held tightly in their hands hoping to get their taxes sent out on time.

April 15th, ‘tax day’, always seems to be a day of chaos and dread for taxpayers – though thru some convoluted rules, ‘tax day’ is actually April 18th this year. We’ve all seen traffic jams and long lines at local Post Offices with last minute taxes held tightly in their hands hoping to get their taxes sent out on time. When preparing for tax time don’t just assume that Federal, State and other income taxes will be the only thing you can declare hoping you’ll get some kind of tax return. Depending on what kind of job or jobs, or what kind of savings or purchases you’ve made, you may qualify to reduce your taxable income and get a larger refund.

When preparing for tax time don’t just assume that Federal, State and other income taxes will be the only thing you can declare hoping you’ll get some kind of tax return. Depending on what kind of job or jobs, or what kind of savings or purchases you’ve made, you may qualify to reduce your taxable income and get a larger refund.