Attention Millennial Parents and Grandparents – Want to do something special for your millennial-aged young person? As we approach tax time, you are familiar with the benefits of retirement savings for yourself and your spouse. Savings for retirement defers the taxes you will pay, and in some cases, like with a Roth IRA, you can avoid paying any additional taxes on the money you invest as well as all future earnings.

Attention Millennial Parents and Grandparents – Want to do something special for your millennial-aged young person? As we approach tax time, you are familiar with the benefits of retirement savings for yourself and your spouse. Savings for retirement defers the taxes you will pay, and in some cases, like with a Roth IRA, you can avoid paying any additional taxes on the money you invest as well as all future earnings.

Well, the same works for your millennial children or grandchildren. After all, they have their entire lives ahead of them. A twenty-something individual has at least 40+ years until they are of retirement age. Who is better suited for benefitting from growth over time?

Say for example you have a grandson who is nineteen years old in their second year of college we’ll call him Nathan.

Nathan is in his second year of college, and works part time earning about $8500 a year. Did you know that Nathan is eligible for a Roth IRA up to $5500 for the (2016) year? Well, the odds are that Nathan himself can’t afford to invest in his Roth IRA at all, after all, he’s a college student and he needs all the extra spending money he can earn. But his parents or grandparents can help him by gifting him the funds.

“We starting doing this with our granddaughter Jessica”, said Maggie S. of Fort Lauderdale, FL, “when she was 17 years old, she worked part-time and earned like under $5000 for the year. We sat down and talked with her about the incredible benefits of compounding interest and dividends and we told her we would do this for her as long as she agreed to not touch the money until she is at least 65. We even had her sign a letter agreeing to this. Now for the last three years, we have deposited between two and three thousand a year in a Roth IRA. We have it invested in a low-cost total stock market index fund.”

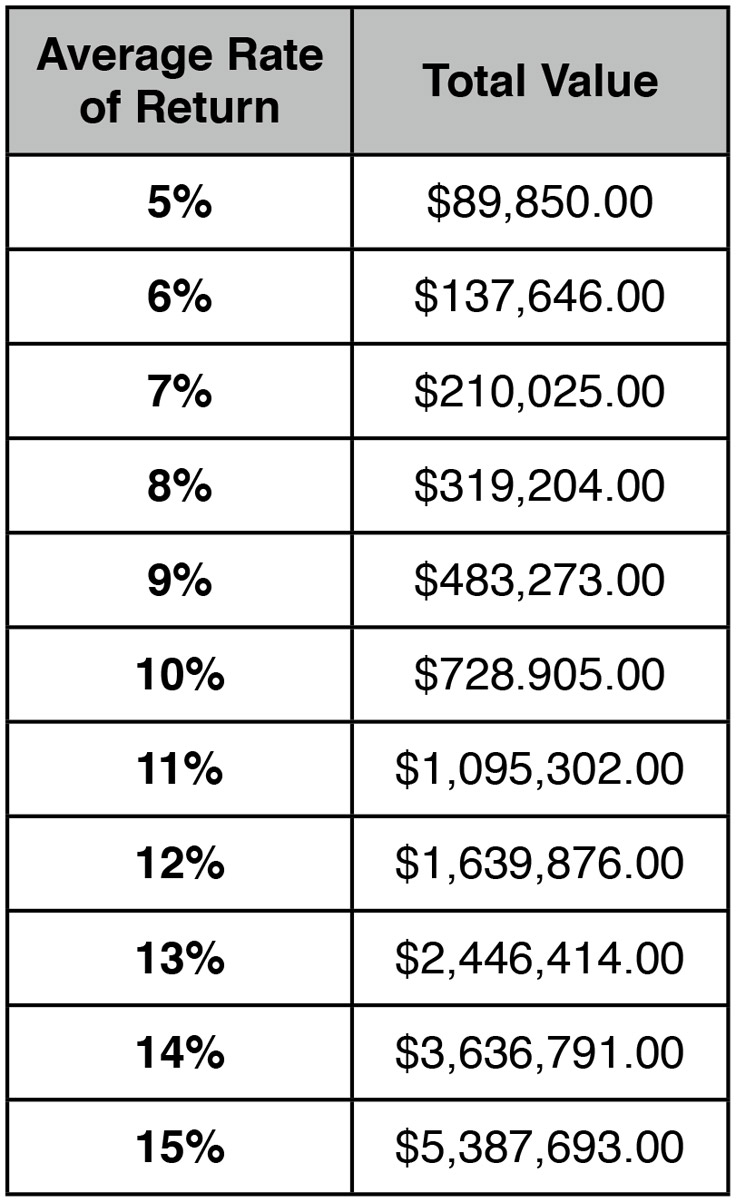

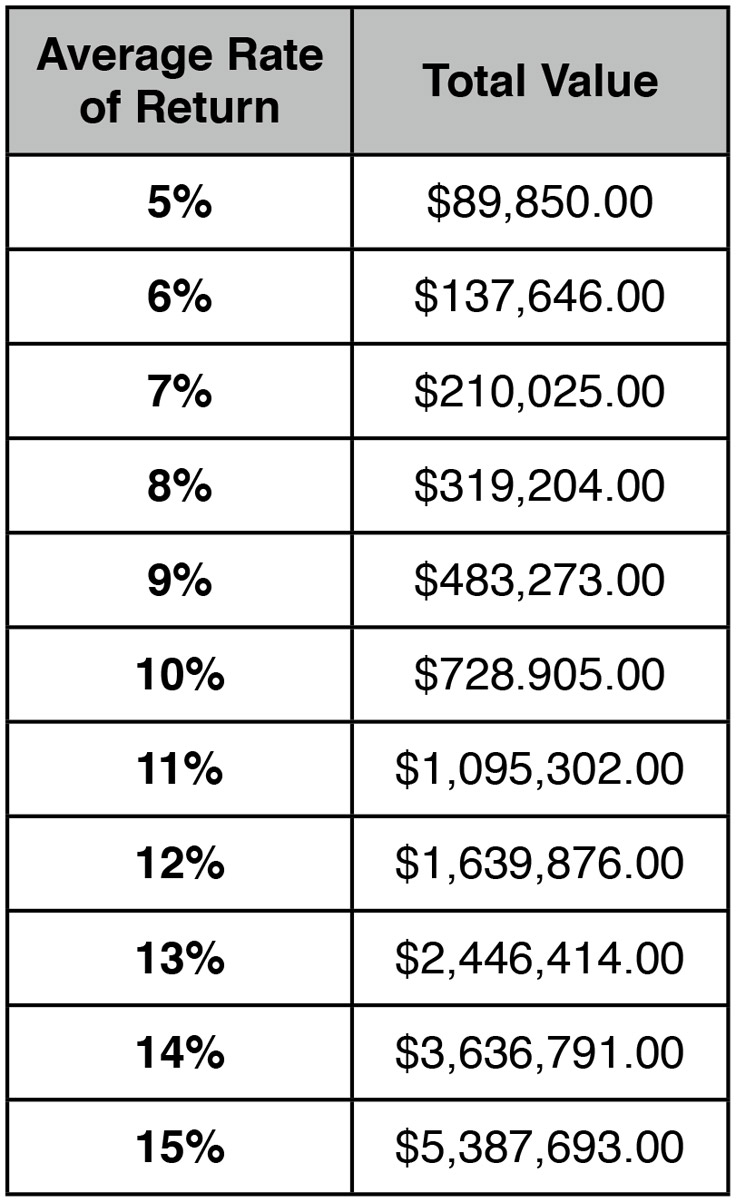

If you want to create a real legacy with long-term benefits, getting your millennially-aged kids into Roth IRA’s at an early age can be huge. For example, if for five years, you invest $2000 each year into a Roth IRA, starting when they graduate from high school – here is an example of the potential long-term growth of this very small initial $10,000 investment.

$10,000 investment’s potential growth over 45 years with all dividends and interest reinvested:

Warren Buffet was recently asked, with his vast wealth of investing knowledge, how would he invest for retirement. He stated that he would keep it very simple. Invest 90% in a low-cost S&P 500 Stock Index Fund and 10% keep in cash or short-term government bonds. You can read his comments by CLICKING HERE

So, keeping it simple, with all the market ups and downs, what has been the historical yearly rate of return of the total stock market since 1966? 11.79%

Here’s a question for you. What’s the most expensive purchase you’ll make in your life? A car? Nope. A house? You might think so but you would be wrong. Actually, it’s your retirement. Bet you didn’t think about that answer.

Here’s a question for you. What’s the most expensive purchase you’ll make in your life? A car? Nope. A house? You might think so but you would be wrong. Actually, it’s your retirement. Bet you didn’t think about that answer.

As if millennials don’t have enough challenges today to secure their finances, there will always be pressure coming from all sides including your friends, co-workers and even the media that will affect the way you spend your money.

As if millennials don’t have enough challenges today to secure their finances, there will always be pressure coming from all sides including your friends, co-workers and even the media that will affect the way you spend your money. The prettiest two words you ever want to hear when investing are: Compounded Interest. A perfect example comes from the one and only Benjamin Franklin.

The prettiest two words you ever want to hear when investing are: Compounded Interest. A perfect example comes from the one and only Benjamin Franklin.

Attention millennials, now, listen up! It’s important to have a personal financial plan. Here is the top ten list for college-aged folks, that will help you with smart money practices and habits:

Attention millennials, now, listen up! It’s important to have a personal financial plan. Here is the top ten list for college-aged folks, that will help you with smart money practices and habits: Sometimes stepping back and looking at where you stand can have a great impact on your approach to things. The same can be said for a Career Plan. At various stages of your life, having a Career Plan, and reviewing that plan can keep you on the right path, helping you achieve a higher salary, job security and a rewarding career – doing what you love.

Sometimes stepping back and looking at where you stand can have a great impact on your approach to things. The same can be said for a Career Plan. At various stages of your life, having a Career Plan, and reviewing that plan can keep you on the right path, helping you achieve a higher salary, job security and a rewarding career – doing what you love. Identity theft is a big problem. If someone gains control of your personal information they might be able to open accounts, file taxes and make purchases in your name.

Identity theft is a big problem. If someone gains control of your personal information they might be able to open accounts, file taxes and make purchases in your name. April is National Financial Literacy Month, Talkin’ Money’s favorite month! To celebrate the importance of being financially literate, we’re going to post financial literacy tips every day.

April is National Financial Literacy Month, Talkin’ Money’s favorite month! To celebrate the importance of being financially literate, we’re going to post financial literacy tips every day. Attention Millennial Parents and Grandparents – Want to do something special for your millennial-aged young person? As we approach tax time, you are familiar with the benefits of retirement savings for yourself and your spouse. Savings for retirement defers the taxes you will pay, and in some cases, like with a Roth IRA, you can avoid paying any additional taxes on the money you invest as well as all future earnings.

Attention Millennial Parents and Grandparents – Want to do something special for your millennial-aged young person? As we approach tax time, you are familiar with the benefits of retirement savings for yourself and your spouse. Savings for retirement defers the taxes you will pay, and in some cases, like with a Roth IRA, you can avoid paying any additional taxes on the money you invest as well as all future earnings.