From Yahoo – Medical professionals often leave school with jaw-dropping amounts of student loan debt. Among 2014 graduates from medical school, for example, most (84%) reported having education debt, with a median amount just over $176,000, according to the Association of American Medical Colleges. Even if they earn high incomes when they graduate (physicians, for example, are among the highest earners in America), by the time that debt — with interest — is repaid, the tab can be significantly higher.

Author Archives: GW

7 do’s and don’ts of student loans for millennials

From Fidelity.com, some great advise on student loans.

When Philly resident Chenell Tull’s grace period ended 6 months after graduation, her $45,000 in private loans turned into $52,000. That’s because post-grace period, the student loan companies took the interest that had accrued while Tull was in school and added it to the principal.

When Philly resident Chenell Tull’s grace period ended 6 months after graduation, her $45,000 in private loans turned into $52,000. That’s because post-grace period, the student loan companies took the interest that had accrued while Tull was in school and added it to the principal.

Follow this link for the ret of the article: https://www.fidelity.com/insights/personal-finance/student-loans-for-millennials

Lions WR Sticks to a Tight Budget

From Bleacher Report – ESPN.com’s Michael Rothstein published a story last Friday about Detroit Lions wide receiver Ryan Broyles, highlighting the player’s steadfast approach toward long-term financial security.

Rothstein’s piece focuses on the figure of $60,000—a mark Broyles notes as his “give or take” annual expenditure target for lodging, food, entertainment and living expenses for him, his wife and newborn.

Advice for New Students From Those Who Know (Older Students)

From the NYTimes, some great advise for new students, from older students…

New supplies, new clothes, new start. Freshman year is a chance to redefine yourself, to challenge assumptions, to lay the foundation for the rest of your life. Gee whiz, you say, I’m just 18! So we asked for help, from those who have been there, done that. Below are words of wisdom from 25 upperclassmen and recent grads. See the comments section for additional reader submissions.

EXTEND YOURSELF

As an incoming freshman I wish I’d known I didn’t need to know everything! I was so wrapped up in the idea that I had to know my major, how to navigate campus and the social scene, even how to do laundry. Sometimes the beauty is in figuring these things out organically. To be a successful freshman, you just have to be willing to learn as you go. — Grace Carita, Bucknell University, ’18

The first day of college I was a ball of nerves and I remember walking into my first class and running to the first seat I found, thinking everyone would be staring at me. But nobody seemed to notice and then it hit me: The fact that nobody knew me meant nobody would judge, which, upon reflection, was what I was scared of the most. I told myself to let go. I began to force myself into situations that were uncomfortable for me — for example, auditioning for a dance piece — and the performance was a highlight of my freshman year. Challenge yourself to try something new, something you couldn’t have done in high school. — Ria Jagasia, Vanderbilt University, ’18

Four Steps to Choosing a College Major

From the NYTimes – What will you be doing on this date 20 years from now? No, really. Try to answer that. Given what you know about your ever-changing self, and factoring in the breakneck pace of societal change, can you accurately predict what the future world around you will look like and what role you’ll play in it?

Click here to continue the article.

A Will – I’m Young, Why Do I Need to Think About That!

A Will? Me? I’m young, I have plenty of time. Read on and learn, Sherlock.

From Daily Finance – Little more than half (56 percent) of American parents have a will or living trust document, according to a Caring.com survey of adult children. Nearly one-third of parents (27 percent) don’t have estate documents in place and 16 percent of adult children are unsure if their parents do. Of those that do have a will, only 40 percent have updated it in the last five years. Almost a quarter of adult children don’t know if their parents’ will has ever been updated.

Click here to read morehttp://www.dailyfinance.com/2015/07/15/estate-planning-mistakes-avoid/

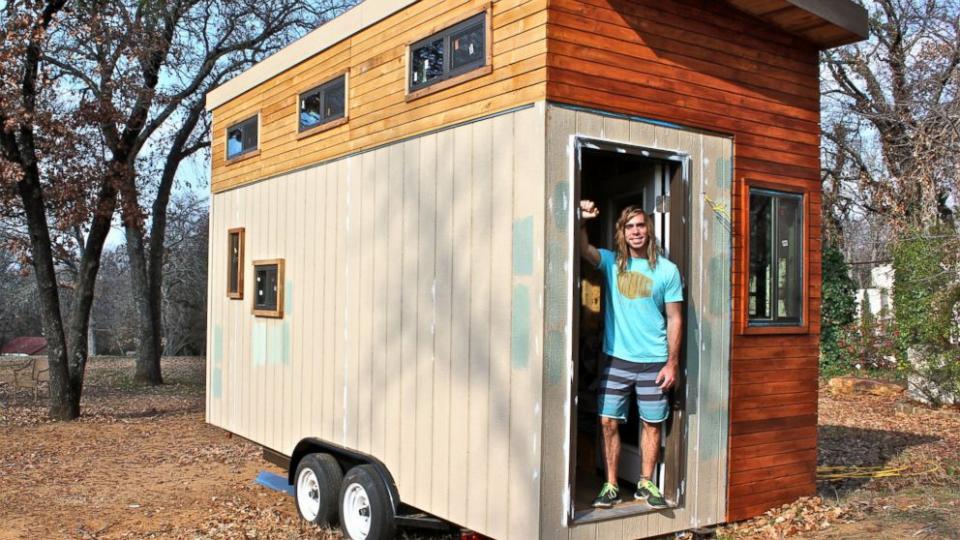

Want To Avoid College Debt?

Sometimes just being clever is the best way to save yourself money! From Good Morning America – Texas Man Builds Miniature House in Hopes of Avoiding College Debt!

Joel Weber said he’s determined to incur less college debt by living in the tiny, 145-square-foot house he built, rather than struggling to pay higher rent in his college town of Austin, Texas.

“I wanted a place to call home,” Weber told ABC News. “I wanted it to be affordable so I could be debt-free and let it be an investment to give back to the community — not just dumped into rent that I wouldn’t get any return on.”

Weber, who will begin his junior year at the University of Texas at Austin, said it can cost upwards of $800 a month to live in the area near his school.

Click here for more of the article

Here’s what happens when you stop paying your student loans.

From Yahoo – Two years after leaving school, students default on their federal loans at a rate of 9.1%, according to a 2013 report by the New York Federal Reserve. That figure jumps to 13.4% at the three-year mark.

Pulitzer Prize-nominated author Lee Siegel wrote an op-ed article in The New York Times on Saturday in which he advised people to default on their student loans rather than remain stuck with crippling debt.

But what actually happens when you default?

Click here to continue with the article

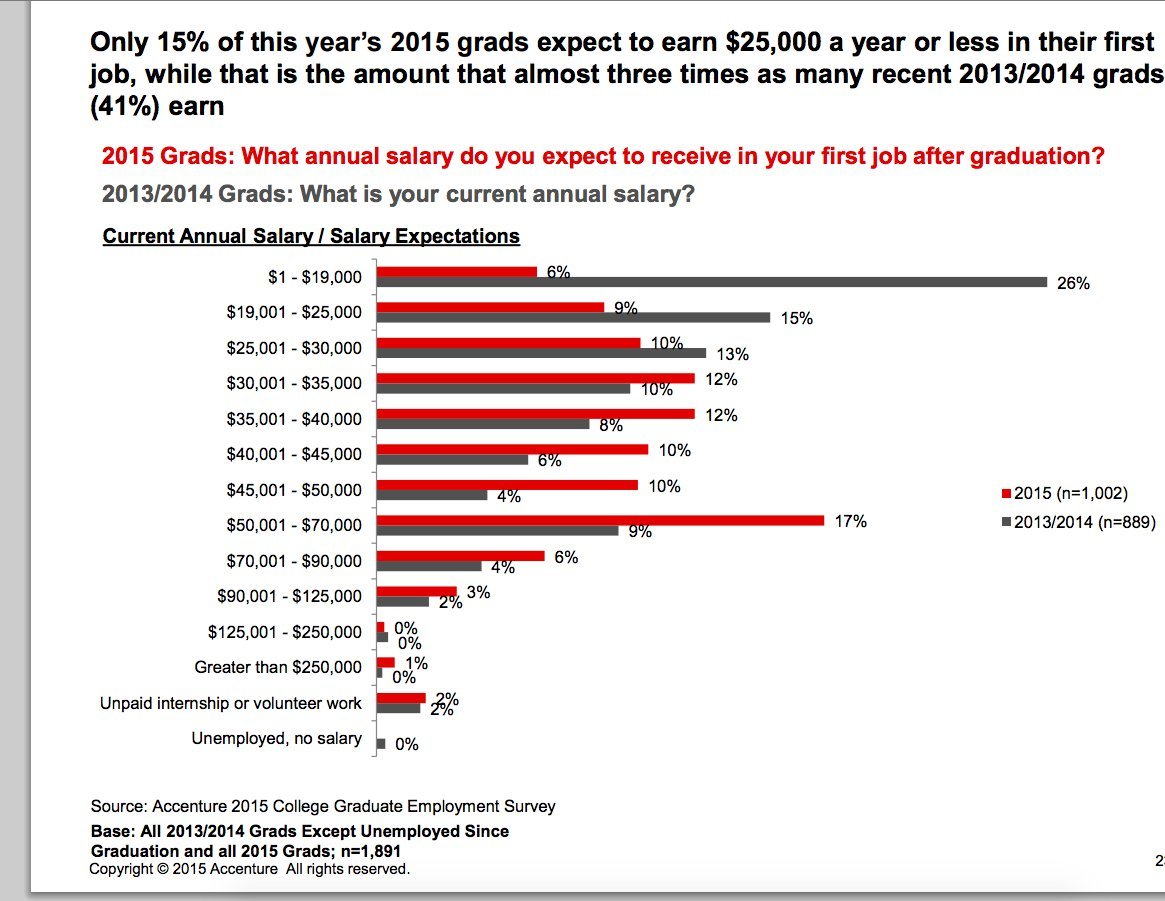

A Rude Awakening on Pay for The Class of 2015

From HuffPost – Leaving college for the “real world” can be a jarring experience for any new graduate. And if a new survey is any indication, a particularly unpleasant surprise awaits the bright-eyed, fresh-faced class of 2015 when they get those first paychecks.

What new graduates expect to earn in their first job is pretty different from what grads of 2014 and 2013 have actually been making, according to a survey released Tuesday by the consulting firm Accenture.

Click here for more

The Pros and Cons of Avoiding Credit Cards

From the NYTimes –

Millennials are far more likely than older adults to make do without credit cards.

More than 60 percent of millennials — defined as those age 18 to 29 — said they did not have a single major credit card, according to a survey published this week by Bankrate.com. In contrast, 35 percent of adults over 30 said they had no cards. (For the survey, Princeton Survey Research Associates International interviewed 1,161 people by telephone in late July and early August. The margin of sampling error is plus or minus 3 percentage points.)