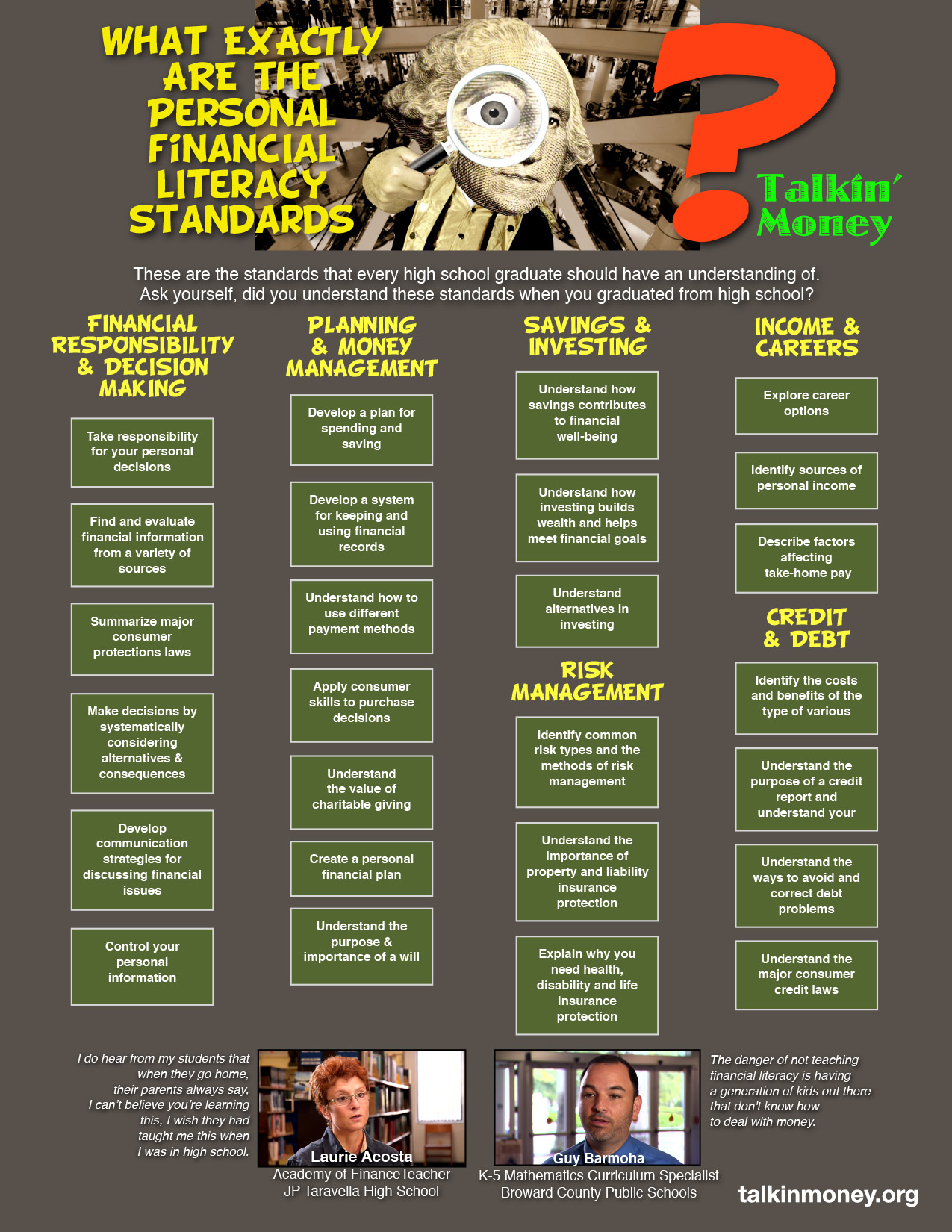

So, what exactly are the standards for financial literacy? What should a high school graduate know when they walk down the aisle for that diploma? Here are the financial literacy standards we are using to craft the shows we do – ask yourself how much did you know when you graduated high school?

Author Archives: GW

Talkin’ Money Pops Up In Times Square!

What do you know…we made it to Times Square!

Talkin’ Money’s National Distributors

“Talkin’ Money”, the Emmy Award-winning financial literacy educational video series targeted to millennials is pleased to announce that is has entered into two national distribution agreements.

Effective immediately, the distribution of first season’s episodes to high school and college-aged young adults throughout the United States and Canada will be provided through two separate distributors: Learn360 and SAFARI Montage.

Learn360 serves more than 25 million students in over 25,000 schools across the United States and Canada.

SAFARI Montage provides K–12 school districts with a fully integrated Digital Learning Platform, including a Learning Object Repository, Video Streaming Library, and IPTV & Live Media Streaming, designed to handle video efficiently. SAFARI Montage’s core solutions are presently being used successfully in over 600 U.S. school districts comprising 11,000 schools.

How should you manage your money?

Managing your money should be pretty straightforward, but that doesn’t make the task all that easy. This NYTimes article has some great advise.

Managing your money should be pretty straightforward, but that doesn’t make the task all that easy. This NYTimes article has some great advise.

Managing your money should be pretty straightforward, but that doesn’t make the task all that easy.

That’s the biggest takeaway from the handful of simple financial instruction lists making the rounds among the New Year’s resolution set.

One list comes in the form of a 4-by-6 notecard that went viral in 2013, now the foundation of a book called “The Index Card: Why Personal Finance Doesn’t Have to Be Complicated.” Another is the 18 steps at the back of Jonathan Clements’s “Money Guide 2016.” An older but beloved (and newly updated for this column) list comes from the Dilbert cartoonist Scott Adams.

Talkin’ Money Wins Emmy Award!

Wow! Talkin’ Money was awarded an Emmy Award in the Educational/Schools category from the National Academy of Television Arts and Sciences Suncoast Chapter.

In addition to the award for the television show, Steve Procko was nominated for an Emmy as the Editor of Talkin’ Money.

Happy Holidays from Talkin’ Money!

Wishing you all a great Holiday Season – Let’s be financially literate out there

Student Debt in America: Lend With a Smile, Collect With a Fist

From the New York Times today, The American student loan crisis is often seen as a problem of profligacy and predation. Wasteful colleges raise tuition every year, we are told, even as middle-class wages stagnate and unscrupulous for-profit colleges bilk the unwary. The result is mounting unmanageable debt.

Follow this link to the full story: http://www.nytimes.com/2015/11/29/upshot/student-debt-in-america-lend-with-a-smile-collect-with-a-fist.html?partner=rss&emc=rss&_r=0

What’s with Social Security Numbers? It’s crazy!

Using your Social Security number for identification is a not a good idea. It’s the number one way you can suffer identity theft. Here’s a great analogy from fivethirtyeight.com.

The Way We Use Social Security Numbers Is Absurd!

The Way We Use Social Security Numbers Is Absurd!

http://fivethirtyeight.com/datalab/the-way-we-use-social-security-numbers-is-absurd/

What’s the deal with Social Security?

Retirement?!! That’s so far off…or is it? Some things to think about at any working age.

One big misconception is that Social Security is going bankrupt. Actually, it’s not,” says Andrew McFadden, Social Security educator

Here’s a great article by Fidelity Investments about Social Security –

https://www.fidelity.com/insights/retirement/what-you-should-know-about-social-security-1

Don’t Buy Stuff!

Seems simple enough, doesn’t it? The sure fire way to get out of debt!

https://video.yahoo.com/dont-buy-stuff-000000884.html?soc_src=unv-sh&soc_trk=fb